31+ Mortgage amount based on income

Stamp Duty Land Tax. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Free Note Examples 31 In Pdf Doc Examples

Lenders mortgage insurance LMI can be expensive.

. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. At 146 of GDP the 2009 and 2010 collections were the lowest level of the past 50 years.

2021 but those who qualify as a Recovery Startup Business can utilize the credit through December 31 2021. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. May 31 2022 PIC1439139 Yanmar VIO 50 mini digger Year 2019 Weight 4855 Hours 1435 with offset boom 2 auxiliary lines mechanical quick coupler GP bucket and Yanmar engine.

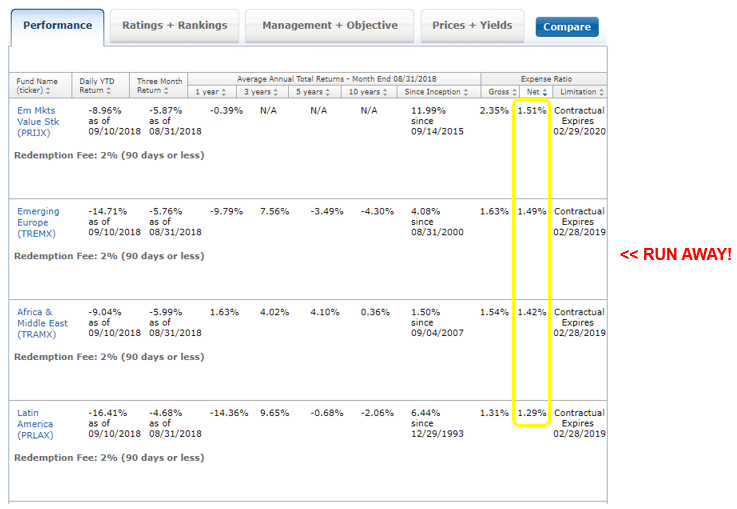

Annual Job Growth Rate Adjusted for Population Growth. Double Weight 208 Points Median Annual Income Growth Rate. Growth compares the income level in 2020 versus in 2019.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Schedule K-1 income is in turn reported on the partners income tax returns. Calculate Your Mortgage Qualification Based on Income.

Partnership Income is allocated to the partners based upon the percentages specified in the partnership agreement by filing Form 1065 US. Section 179 deduction dollar limits. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources.

However a plan may require you to begin receiving distributions by April 1 of the year after you reach age 72 70 ½ if you reach age 70 ½ before January 1 2020 even if you have not retired. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Loan Amount Monthly Income Annual Income.

Reconveyance of mortgage to mortgagor both out of possession not within statute. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Return of Partnership Income with associated Schedule K-1s Partners Share of Income Deductions Credits etc.

What evidence is admissible. Requires compensating factors to get approved at a high ratio. The debt-to-income ratio should not exceed 36 of the gross income.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Possession of mortgagee not adverse. Median Annual Household Income Adjusted for Cost of Living.

Receiving pre-approval is a conditional agreement from a lender to grant you a mortgage based on. This pays for the cost of transferring the mortgage amount. The housing expense or front-end ratio is determined by the amount of your gross income used to pay your monthly mortgage payment.

The Federal Reserve System also known as the Federal Reserve or simply the Fed is the central banking system of the United States of AmericaIt was created on December 23 1913 with the enactment of the Federal Reserve Act after a series of financial panics particularly the panic of 1907 led to the desire for central control of the monetary system in order to alleviate financial. 1500 earned income 550 social security 2050 gross income. Forbearance ends Dec.

After December 31 2022 Members will earn 10000 Hilton Honors Bonus Points at 40 eligible nights and 10000 Hilton Honors Bonus Points for every 10 additional eligible nights thereafter during a calendar year January 1st through December 31st. 2050 is less than the 2871 allowed for a 4-person household so determine net income. Whether conveyance of incorporeal hereditament falls within statute.

If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. The federal personal income tax is progressive meaning a higher marginal tax rate is applied to higher ranges of income. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000.

If you are a 5 owner of the employer maintaining the plan then you must begin receiving distributions by April 1 of the first year after the calendar year in which you reach age 72 70 ½. To calculate the amount of equity in your home review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. From 2008 to 2009 individual income taxes declined 20 while corporate taxes declined 50.

In areas that have higher home prices it is rather hard to stay within 36 so there are lenders that allow the debt-to-income ratio to go as high as 45. The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000. Mortgage not an alienation so as to make the parties liable.

How monthly debt is calculated is that the gross income is multiplied by 036 and then divided by 12. Tax policy Tax descriptions. Plans that can lower your monthly bills based on your income and family size.

The loan is secured on the borrowers property through a process. Determining your monthly mortgage payment based on your other debts is a bit more complicated. Double Weight 208 Points.

USDA eligibility and income limits. The amount you can write off depends on whether the expense is direct it only benefits your home office or indirect it benefits your entire home. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Home insurance also commonly called homeowners insurance often abbreviated in the US real estate industry as HOI is a type of property insurance that covers a private residenceIt is an insurance policy that combines various personal insurance protections which can include losses occurring to ones home its contents loss of use additional living expenses or loss of other. Here is our guide to deductions for you home based business. If gross monthly income is less than the limit for household size determine net income.

Double Weight 208 Points Note. A mortgage in itself is not a debt it is the lenders security for a debt. Youll have to pay more likely the standard repayment plan amount.

Stamp Duty break was announced in July 2020 and due to end on March 31 2021. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

The Measure Of A Plan

Axos Financial Inc Free Writing Prospectus Fwp

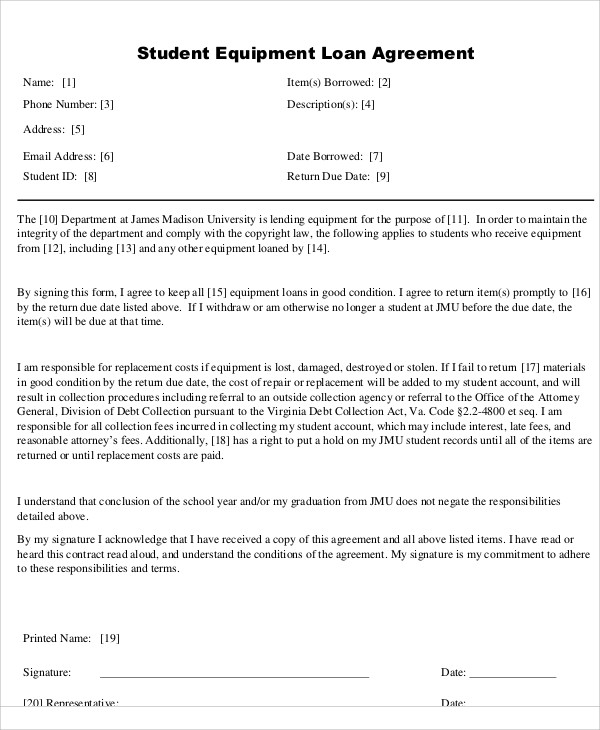

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

G201504061231509392619 Jpg

![]()

Should You Skip Mortgage Payments If You Don T Have To

Pin On Bible Study

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

Free Printable Promissory Note Promissory Note Notes Template Templates Printable Free

Pin Page

Pin On Bible Study

How To Save Money Fast 3 Tricks Above 1000 Hr

![]()

The Measure Of A Plan

Axos Financial Inc Free Writing Prospectus Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Tips For First Time Home Buyers Myhomeanswers

Axos Financial Inc Free Writing Prospectus Fwp